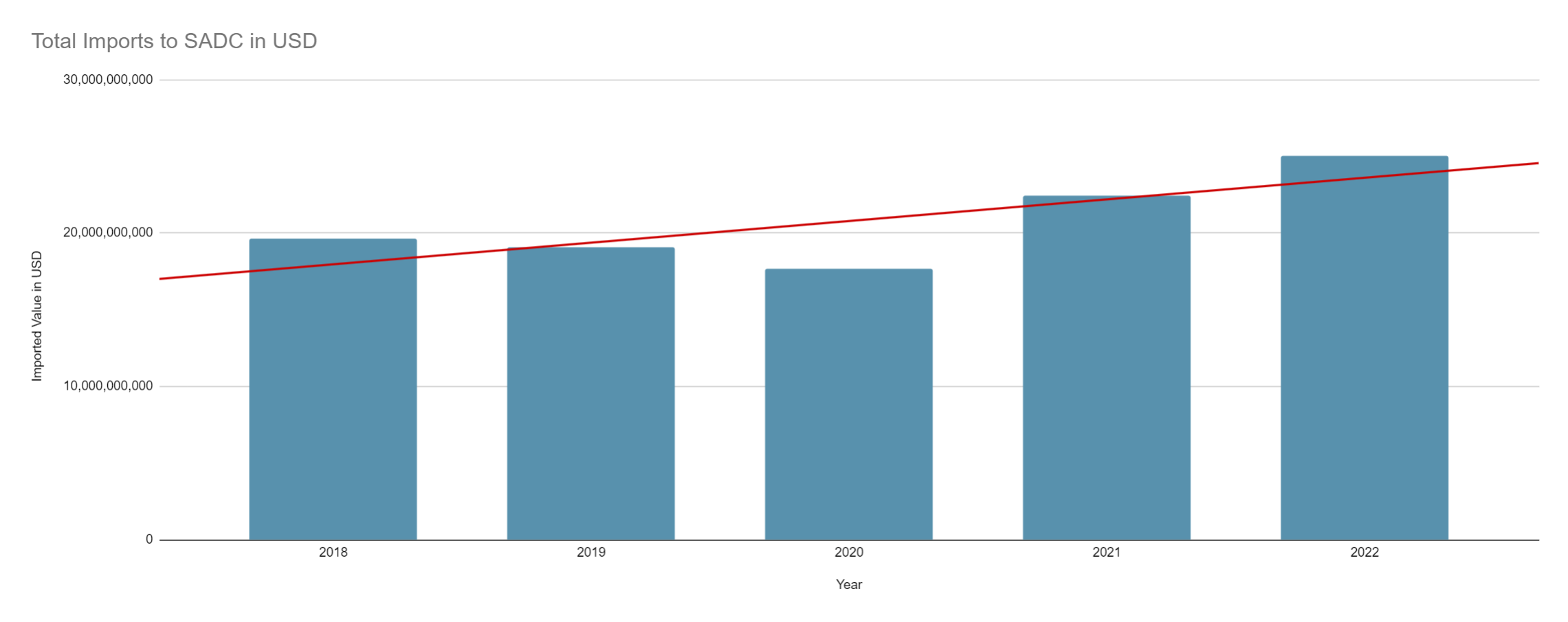

The diverse economies of Southern Africa have a growing demand for international trade. This growing demand presents both an opportunity and a challenge for companies operating cross-border logistics operations in the region.

Data gathered from trademap.org

Let’s delve into the intricacies of cross-border trading in Southern Africa while exploring the benefits and challenges regional companies face. We will also share how Blackie’s Consultants, a key player in facilitating cross-border trading, can assist businesses in navigating this dynamic landscape.

Diversification of Investment Opportunities

Southern Africa is rich in investment potential, offering various markets and industries for companies to explore. Engaging in cross-border trading allows companies to diversify their clients’ portfolios, reducing risks associated with single-market exposure.

Increased Market Access

Cross-border trading broadens the scope of potential markets for companies. Companies can access multiple regional exchanges and needs, providing their clients with more investment options.

Enhanced Liquidity and Market Efficiency

Companies contribute to market liquidity by connecting buyers and sellers across borders. Increased liquidity attracts more investors and enhances market efficiency, leading to better price discovery and reduced transaction costs.

Risk Mitigation

Diversification across different Southern African markets allows local businesses to manage risk more effectively. When one market experiences fluctuations or downturns, investments in other markets provide stability, reducing overall portfolio risk.

Economic Growth and Regional Integration

Businesses play a role in promoting regional integration by facilitating cross-border trading. As trade barriers are reduced and economic cooperation increases, the region experiences growth, attracting further investment.

Challenges for Companies

Southern Africa comprises multiple countries with its regulatory framework. Businesses must navigate varying rules, regulations, and reporting requirements, which can be complex and time-consuming.

Currency Risk

Exchange rate fluctuations can significantly impact the returns on cross-border investments. Local companies must employ risk management strategies to mitigate currency risks effectively.

Legal Barriers and Documentation

Different countries may have legal barriers and extensive documentation requirements. Companies must ensure that they and their clients comply with these regulations to avoid legal disputes and penalties.

Political and Economic Volatility

Some Southern African countries may face political instability and economic volatility. Businesses need to stay informed about these factors to make informed investment decisions.

Infrastructure and Connectivity

Access to markets can be challenging in some regions due to inadequate infrastructure and connectivity issues. Local companies must consider these factors when executing trades.

Navigating the Cross-Border Landscape

Blackie’s Consultants is a renowned player in Southern Africa’s cross-border trading landscape. With a deep understanding of the region’s complexities, they provide various services to facilitate cross-border trading.

Regulatory Expertise

Blackie’s Consultants offer guidance on navigating the intricate regulatory environments of multiple Southern African countries, ensuring compliance and minimising risks for their clients.

Currency Risk Management

They assist clients in managing currency risk, providing strategies to mitigate the impact of exchange rate fluctuations on investments.

Compliance Support

Blackie’s Consultants assist clients in fulfilling customs compliance requirements, from documentation to tax reporting, reducing the administrative burden on companies and investors.

Risk Mitigation

Focusing on risk management, they help clients identify and address potential risks associated with cross-border trading.

Cross-Border Trading in Southern Africa with Blackie’s

Cross-border trading in Southern Africa offers substantial benefits to companies, such as diversification, increased market access, enhanced liquidity, and the promotion of regional integration. However, challenges related to regulatory complexity, currency risk, legal barriers, and political and economic volatility require careful navigation.

Blackie’s Consultants, with their expertise and comprehensive services, play a vital role in supporting companies and investors in overcoming these challenges. Their commitment to facilitating cross-border trading in Southern Africa contributes to the region’s economic growth and investment potential.

As Southern Africa continues to evolve as a hub for cross-border trading, companies can seize opportunities with the assistance of experts like Blackie’s Consultants. To learn more about how Blackie’s Consultants can help you navigate the cross-border trading landscape in Southern Africa, visit their website.