Customs Clearing Instruction

When trading cross border, communication is of vital importance. When conducting business with Blackie’s Consultants it is compulsory to start with a Clearing Instruction. This is the very first form of communication between us and you, our client.

clearing instruction Overview

The said person shall further produce the transport document or such other document in lieu thereof as may be approved by the Commissioner, invoices as prescribed, shipper’s statement of expenses incurred by him, copy of the confirmation of sale or other contract of purchase and sale, importer’s written clearing instructions, unless exempted by rule, and such other documents relating to such goods as the Controller may require in each case and answer all such questions relating to such goods as may be put to him by the Controller, and furnish in such manner as the Commissioner may determine such information regarding the tariff classification of such goods as the Commissioner may require.

This entitles the clearing agent to use the clearing instruction as a lawful legal document and declare it as compulsory.

The client completes the clearing instruction. This will act as a written instruction given to the clearing agent to:

1. Act on behalf of the client as the clearing medium

2. Utilize the recorded details on the clearing instruction to proceed with the clearing of the load.

The client or any other nominated member of the client’s company may complete the clearing instruction.

At no point is a member of Blackie’s Consultants allowed to complete this form on behalf of the client. Blackie’s Consultants will not continue with any paperwork until they have received a proper clearing instruction.

Direct Export – when a Lesotho client buys goods from a South African supplier and the South

African supplier transports the goods, either with his own transport or makes use of transporter,

deliver the Lesotho client’s goods to them in Lesotho.

Indirect Export – when a Lesotho client buys goods from a South African supplier and the

Lesotho client comes to South Africa, picks up his/her goods themselves or by means of arranged

transport and takes it to their place of business in Lesotho.

1. Firstly, does the client have a valid Importers/Exporters code. If not, they will be instructed to apply. Failure to comply will

result in no future assistance. For SARS auditing purposes, it is important that each company has their own valid code.

2. The clearing instruction must have been completed by a representative of the client’s company, should Blackie’s

Consultants feel its incomplete it will be sent back to the client with a query.

3. Blackie’s Consultants will then check if the invoices attached to the clearing instruction is in good clear readable print and

relevant to the clearing instruction. This is time consuming as they need to check that all invoice numbers, descriptions

and values as recorded on the clearing instruction corresponds. If not, they will be unable to continue, as the direct

instruction differs from the actual invoices being presented.

If a client wishes to make any changes, you the client must supply Blackie’s Consultants with a new clearing instruction.

Never give another company your Importers/Exporters code to clear goods. The company that the code is registered for will have to take full responsibility for any penalties and audits that might occur.

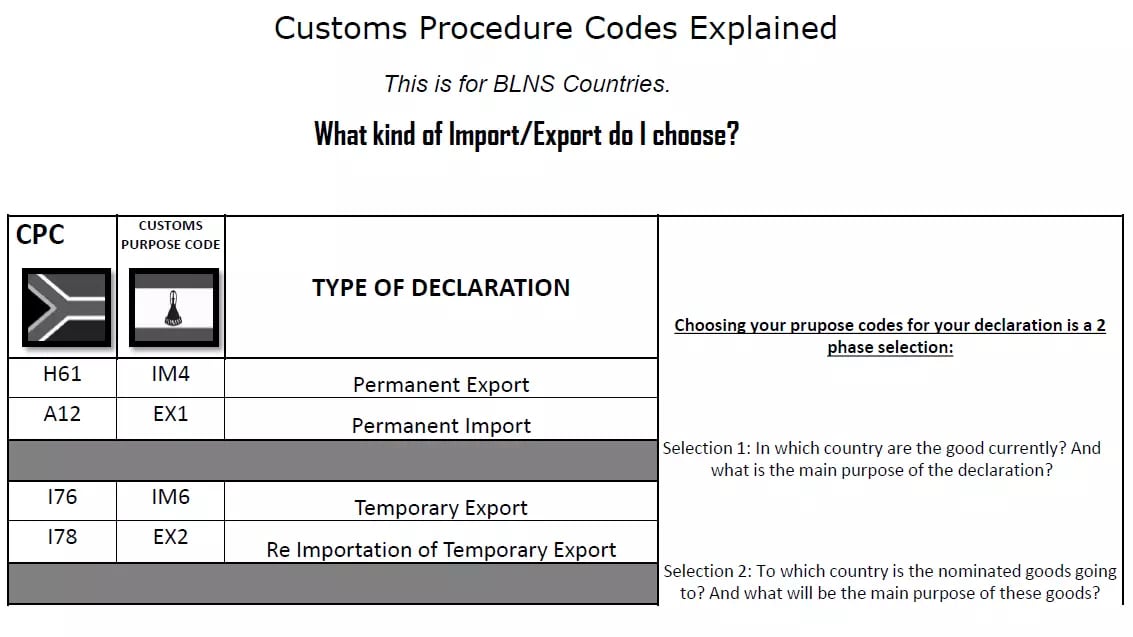

This is for countries Botswana, Lesotho, Namibia and Eswatini.

How to determine what kind of import/export to choose:

It is required by law that each consignee have its own clearing instruction even though it is physically on the same truck.

Unless it is for the same company yet different address. However, if all the goods go to the same consignee only one clearing instruction is needed.

It is of utmost importance that weights and quantities be declared accurately. Being declared wrongfully, guessed or just not recorded at all by the client will result in time consuming delays.

SARS and/or LRA will question information that seems inaccurate, and demand a VOC and/or issue a penalty to the relevant party for being negligent.

In addition, this will raise a concern for what may seem like smuggling, under-declaring of goods and/or values.

As this is a serious error to make, VOC’s become increasingly difficult to explain to SARS/LRA, hence the cost increase.

Should an invoice on the load be selected for inspection, it is the responsibility of the consignor to complete an individual clearing instruction for the nominated invoice that is being inspected.

Customs Clearing Application

If you would like to apply for our customs clearing services, kindly fill out the form below and our consultants will contact you shortly.

Please do not hesitate to contact us should you have any questions.

Privacy Policy | Copyright © 2025 – All Rights Reserved | Site by Xponent